That means the company has paid its average AP balance 2.29 times during the period of time measured. That all depends on the amount of time measured, along with current AP turnover ratio benchmarks and trends over time in the SaaS industry. In and of itself, knowing your accounts payable turnover ratio for the accessories past year was 1.46 doesn’t tell you a whole lot. Meals and window cleaning were not credit purchases posted to accounts payable, and so they are excluded from the total purchases calculation. The inventory paid for at the time of purchase is also excluded, because it was never booked to accounts payable.

- You’ll often have invoices for each of these accrued expenses, but in some cases, you might not.

- It can show cash is being used efficiently, favourable payment terms, and a sign of creditworthiness.

- The report lists all your company’s unpaid invoices, grouped by their due dates and how long they’ve been outstanding.

- The AR turnover ratio measures how quickly cash is collected from customers.

Accounts payable turnover ratio: Definition, formula & examples

See our overall favorites, or choose a specific type of software to find the best options for you. We believe everyone should be able to make financial decisions with confidence.

How Can You Improve Your Accounts Payable Turnover Ratio in Days?

But choosing not to ignores a significant opportunity for growth, especially if you can run AP reports with just the click of a button. Reports help you maintain healthy AP processes, ensure accurate financial statements, build better supplier relationships, and improve financial decision-making. This means that Company A paid its suppliers roughly five times in the fiscal year.

The Impact of Accounts Payable Turnover Ratio on Financial Health and Creditworthiness

The accounts payable turnover ratio can reveal how efficient a company is at paying what it owes in the course of a year. A high AP turnover ratio means you’re paying your suppliers quickly, whereas a lower ratio shows that you pay suppliers back more slowly. Most businesses build a report that tracks this ratio every month or quarter to see a trendline, which can provide insight into your cash flow management and financial position. Determine whether your cash flow management policies and financing allow your company to pursue growth opportunities when justified.

What the AP Turnover Ratio Can Tell You

If the company can’t collect receivables quickly, there will be little cash. With little cash, it would be impossible to pay suppliers quickly, which would then result in a low A/P turnover. Overall, it is beneficial to analyze these two ratios together when conducting financial analysis. To improve cash flow consider how you can speed up your accounts receivable process, and incentivize customers to pay faster. One way to improve your AP turnover ratio is to increase the inflow of cash into your business.

In other words, the accounts payable turnover ratio is how many times a company can pay off its average accounts payable balance during the course of a year. Accounts Payable Turnover Ratio is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable. It is a financial ratio that helps in the analysis and evaluation of creditor payment policies and procedures. In simple terms, the Accounts Payable Turnover Ratio indicates the number of times a company pays its suppliers, vendors, and other creditors during a specific period. The ratio measures how many times a company pays its average accounts payable balance during a specific timeframe. The ratio compares purchases on credit to the accounts payable, and the AP turnover ratio also measures how much cash is used to pay for purchases during a given period.

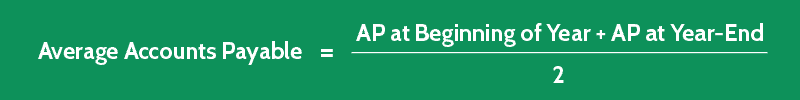

In essence, both ratios are measures of a company’s liquidity and the efficiency with which it meets its short-term obligations. When Premier increases the AP turnover ratio from 5 to 7, note that purchases increased by $1.5 million, while payables increased by only $100,000. Below we cover how to calculate and use the AP turnover ratio to better your company’s finances. When this sum is subtracted from the firm’s opening inventory amount for the same year, it will give you a workable supplier purchases figure to plug into the AP payable turnover ratio.

Not only is a higher ratio result a sign of financial strength, it also shows creditors that the business has an established track record of paying its bills in a timely manner. Only supplier purchases on account are included in this ratio, since cash purchases don’t contribute to a company’s payables. Getting the data you need is important, but accessing it quickly ensures you can spend your time analyzing the metrics and developing proactive strategies to move the business forward. This comprehensive financial analysis gets to the heart of proactive decision-making so you’re always looking forward and incorporating agile planning to help the business succeed. Request a personalized demo today to find out how to take your analytics to the next level with our financial dashboards and improve efficiency and profitability for the company. To improve your AP turnover ratio, it’s important to know where your current ratio falls within SaaS benchmarks.

It indicates that a company is paying its creditors faster and more frequently than a company with a low ratio. However, other factors such as industry standards, payment terms, and business models can impact the ratio. A low Accounts Payable Turnover Ratio may indicate that a company is experiencing cash flow problems, supplier relationship issues or may be taking advantage of extended payment terms. It is crucial to compare the ratio with industry benchmarks and analyze the components of the ratio to interpret the results correctly. AP aging comes into play here, too, since it digs deeper into accounts payable and how any outstanding debt could affect future financials. An AP aging report allows you to organize the total amount due into 30-day “buckets”, so you can track payments that are due and payments that are overdue.

One of the most common ways to accommodate for this lack of information is to add the cost of goods sold in a given year to a company’s year-end inventory figure. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here’s a step-by-step guide to make the most of your Accounts Payable Turnover Ratio Calculator. In short, it’s a tool for maintaining financial harmony and avoiding the dissonance of overdue payables.